TD Bank recants testimony, fires law firm, and US judge eyes punishment in historic AML-fraud civil case

April 25, 2012

By ACFCS Staff

The landmark case that produced the first civil verdict against a bank for "aiding and abetting fraud" by means

of its collusion with a customer and assistance in laundering the fraud proceeds has taken another startling turn.

TD Bank, which recently suffered a $67 million adverse jury verdict in January to Coquina Investments, a victim of

fraudster Scott Rothstein, this week told district Judge Marcia G. Cooke that evidence the bank previously and

repeatedly said did not exist has materialized.

The stunning development comes on the heels of a March 26 formal accusation by TD Bank's adversary in the case,

Coquina Investments, that a "Customer Due Diligence form" the bank and its lawyers had presented in evidence at

trial had been doctored to hide the "high risk" status in which the bank had placed Rothstein.

Rothstein, a former Ft. Lauderdale lawyer and convicted Ponzi schemer, is serving a 50-year prison term and may

be the most toxic customer the giant Canadian-based institution ever had. Coquina sued the bank and Rothstein in

2011.

Even with case on appeal, trial judge will consider sanctions on bank, lawyers

Even though the case is now on appeal by the bank before the 11th Circuit Court of Appeals, in Atlanta, Judge

Cooke promptly set a hearing after learning of the latest revelations involving one of the world's largest

financial institutions and largest law firms.

On May 17, Judge Cooke will hear a motion for sanctions filed by Coquina's lawyer, David Mandel, of Miami, for

the allegedly deceptive and doctored Customer Due Diligence form that TD Bank and its former lawyers at Greenberg

Traurig presented in evidence at trial.

TD Bank has asked for more time to prepare for the hearing through an "Emergency Motion to Stay" on April 25. The

bank stated it has discovered that "a conflict may exist between... Greenberg Traurig, TD Bank, and one or more

of TD Bank's employees relating to the production of documents in this case."

TD Bank gave no details of the "conflict," but requested 30 to 45 days to conduct an inquiry. Judge Cooke rejected

the bank's request in an order issued on the same day, and stated, "TD Bank may present any evidence it has

uncovered at the May 17, 2012 hearing."

Judge will consider holding Greenberg Traurig in contempt for "incorrect representations"

Judge Cooke said in her "endorsed order" of April 24 that the hearing will also require "Counsel for TD Bank

[referring to lawyers at Greenberg Traurig] (to) show cause why they should not be held in contempt for making

incorrect representations to this Court regarding the document titled 'Standard Investigative Protocol.'"

TD Bank and the Greenberg lawyers had repeatedly maintained at trial and in court filings that this "Standard

Investigative Protocol" did not exist. On April 24, the bank recanted this trial testimony and produced the

Protocol to Coquina's lawyers.

On the same day that Judge Cooke set the May 17 hearing, TD Bank filed a Motion for Substitution of Defense

Counsel by which it dismissed Greenberg Traurig and brought in the firm of McGuireWoods.

Case demonstrates consequences of financial institution's toxic customer

From 2005 to 2009, TD Bank held accounts for Rothstein's law firm, which he used in executing his $1.2 billion

Ponzi fraud. In the aftermath of the collapse of Rothstein's fraud, several civil suits by victims have been

filed against TD Bank and Miami-based Gibraltar Bank. Both banks have paid multiple millions in damages, including

money their insurance companies contributed.

TD Bank, Greenberg could face various penalties

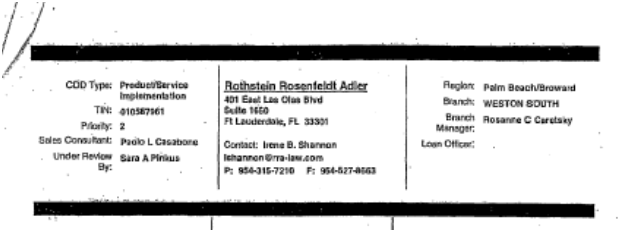

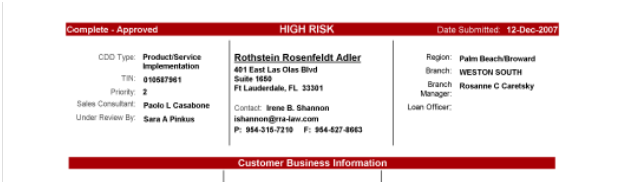

TD Bank used the altered Customer Due Diligence form, which its employees had prepared, to buttress its defense

that it did not consider Rothstein a "high risk" customer. The bank said because Rothstein's firm was not

designated "high risk," it did not conduct the enhanced due diligence that might have detected his fraud.

The form introduced at trial, on which TD Bank's anti-money laundering expert testified, had a simple black bar

across the top. The true version of the form, which was obtained in another case by Coquina's lawyers at Miami's

Mandel & Mandel after the trial, had "HIGH RISK" emblazoned across the top, highlighted in red.

Upon obtaining the true form, Mandel moved for sanctions, alleging that TD Bank had intentionally altered it. He

said "the trial would have proceeded much differently had the defendant produced the true document." TD admitted

the document was altered but blamed a clerical "copying error." It denied it had tampered with evidence to deceive

the jury.

Mandel has asked Cooke to impose sanctions on the bank and Greenberg Traurig, including monetary penalties,

referral of the bank to the Justice Department for criminal inquiry, and referral of the law firm to the Florida

Bar for an ethics probe.

TD Bank admits to incorrect trial statements about "Standard Investigative Protocol"

TD Bank's recent withdrawal of court statements that it did not have a "Standard Investigative Protocol" outlining

steps its anti-money laundering officers follow in customer due diligence investigations ups the stakes at the May

17 hearing before Judge Cook. The bank does not explain why the Protocol was not produced at trial.

According to court documents filed by Mandel, the Protocol first came to light in depositions by TD Bank's AML

investigators. The bank did not produce the document and Greenberg Traurig lawyers told the court "there [were] no

hidden documents regarding the investigative protocol."

Later, Greenberg lawyer Donna Evans told the court, "Mandel... seems to have created a document that doesn't

exist, there is no document called 'Standard Investigative Protocol.'" A footnote in the bank's Notice of

Substitution of Defense Counsel, which reveals its dismissal of Greenberg Traurig, mentions that Evans is no

longer with the firm.

The veracity of these trial statements will probably be a central issue in the May 17 hearing before Judge Cooke.

The bank's disclosure of the Protocol in its April 24 "Notice of Production and Withdrawal of Certain Statements

Made to the Court" puts Evans' truthfulness in doubt. She is believed to have been the firm's "relationship

partner" in the TD Bank representation, meaning she was the source of the bank's legal work.

In a comment to ACFCS, TD Bank spokesperson Rebecca Acevedo stated that "TD and Greenberg Traurig decided it was

in the best interest of all concerned that McGuireWoods represent TD in the Coquina case moving forward." Mandel

& Mandel declined to comment, and Greenberg Traurig could not be reached at the time of publication.

Paul Brinkmann of the South Florida Business Journal has led coverage on the dispute between TD Bank and Coquina

Investments, and has broken several related stories.

Office of the Comptroller of the Currency has taken no action against TD Bank

The Office of the Comptroller of the Currency, TD Bank's principal United States federal regulator, has taken no

action against the bank since the Rothstein megafraud exploded into public view in 2009.

Dean Debuck, a senior OCC spokesperson told ACFCS "We do not comment on ongoing litigation or supervisory matters

involving a specific institution."

(The two versions of the top part of TD Bank's Customer Due Diligence Form for Rothstein's defunct law firm,

Rothstein, Rosenfeldt and Adler, follow. The version presented in the Coquina case appears first, followed by the

unaltered version.)

Related articles:

TD Bank, lawyers accused of "fraud on court" for presenting false "Customer Due Diligence Form".

TD Bank says "copying error" caused altered document in fraud-money laundering case; but victim says that's

nonsense.

READER DISCUSSION

SIVG reserves the right to delete comments that are off-topic or offensive. Excessively long comments may be moderated as well. SIVG cannot facilitate requests to remove comments or explain individual moderation decisions. The comments posted here, express only the views of their authors and not the administrators/moderators from SIVG; for that reason SIVG won't be held responsible for those contents

Showing 0 comments...